According to the White House media office, Vice President declared an end to racial & ethnic discrimination with in appraisal of housing prices in a statement published by White House press office. As first female vice chairman to hold the position, Harris possesses a unique distinction in the history of the country.

People of colour & ethnic minorities will no longer be discriminated against in the appraisal of private real estate properties, according to Vice President Kamala Harris, who announced the policy on Wednesday. A collaborative effort between the Realtor and other stakeholders resulted in the development of this approach, which was the result of a collaborative effort among them. In recent decades, structural injustice has compounded an already-exorbitant wealth disparity, which has been made even worse as a result of a project’s participation in the project’s implementation.

As part of the strategy, 21 efforts to increase monitoring and accountability are being implemented, in addition to a legislative proposal to alter the governance model of the appraisal industry, among other things. The services of the an appraiser can assist prospective house purchasers in determining the worth of their future property, which is required in order to be competent for mortgage financing in the first place.

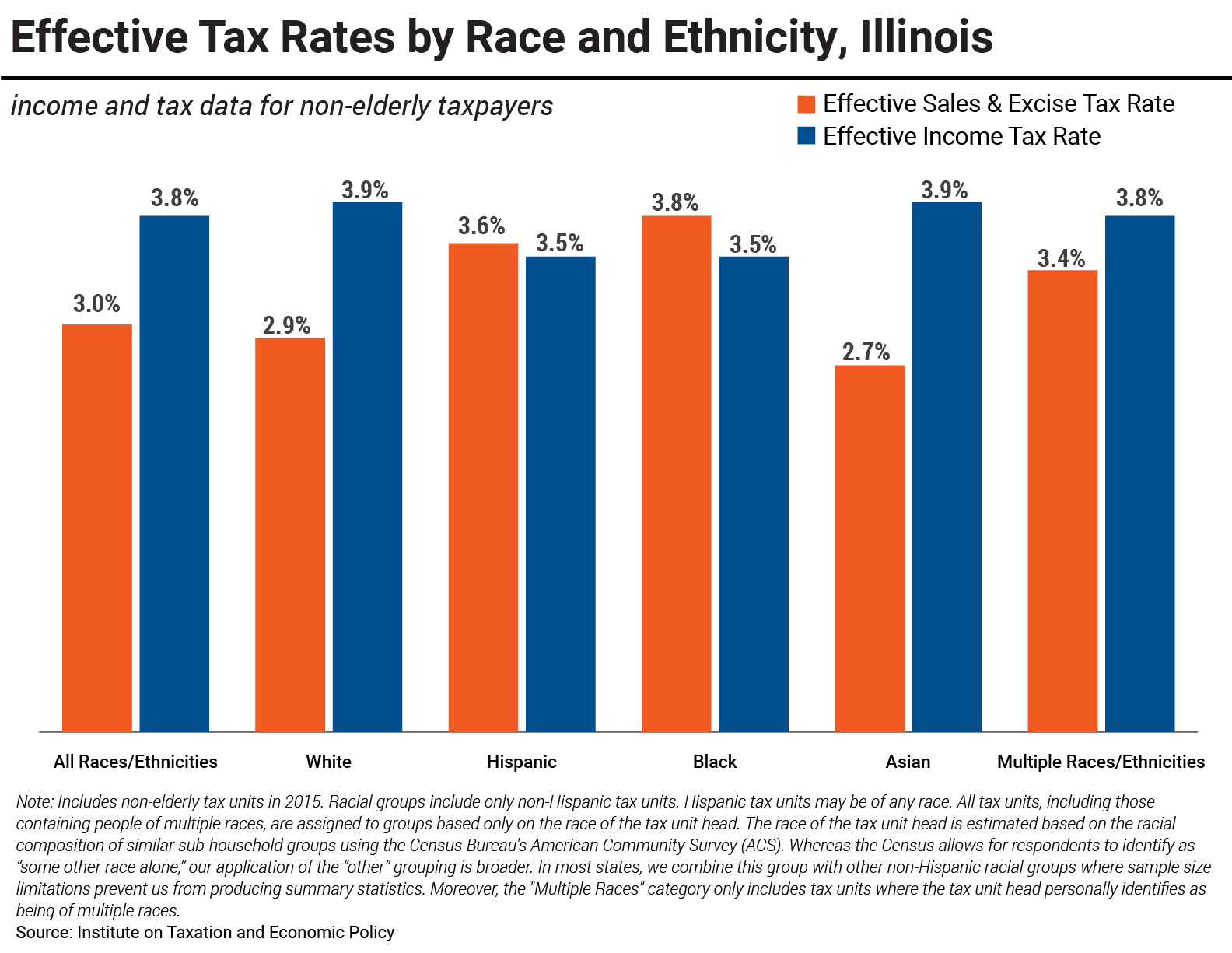

According to the White House, black & Latino Americans typically pay higher mortgage interest rates, receive less money when they sell their homes, and are less like than white Americans to just be qualified for home lines of credit than white Americans are. According to a statement released on Tuesday, President Barack Obama declared that “we will keep on fighting to guarantee that all homeowners & buyers in our society receive equitable treatment.”

According to a series of researches, including one done by mortgage purchaser Freddie Mac, appraisers in Black & Hispanic communities are more likely than other communities to undervalue homes when compared to appraisers in other neighbourhoods, according to the findings. Not only does this type of discrimination contribute to the widening of the wealth gap between white & black people, but also makes it difficult for so many Americans who originate from less fortunate homes to advance up the pyramid.

When a Black owner in Indianapolis chose not to disclose the race on the application & removed all of the family portraits and African American artwork as from house, the appraised valuation of the home increased from $125,000 to $259,000, according to the assessment business.

According to the White House, this plan would result in a large rise in the number of people who are able to file official complaints with Department of Housing & Urban Development (HUD) & the Consumer Financial Protection Bureau, among many other agencies and organisations. Accreditation for appraisal bias training will be included in the homebuyer education classes, which will be offered as component of the program’s overall delivery. Initiatives to guarantee that computers used to value properties do not perpetuate racial prejudices are also being studied, among other things.